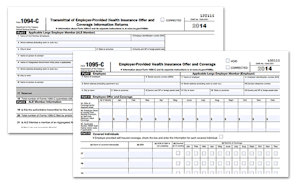

The IRS has just released a notice that extends the due date for delivering 1095-C forms […]

Many HR professionals are returning from much needed vacations (or short stints in rehab) after meeting […]

During this webinar,InfinityHR will share insight into the reporting challenges when receiving notification from the IRS […]